The RefineRE Business Intelligence Suite

Solutions for Facilities Managers

RefineRE empowers Facilities Managers to make data-driven decisions with instant access to dynamic reporting with granular facilities, OpEx, CapEx, and workplace data.

Boost your facilities strategy with data-driven decisions

We know that the responsibility of managing facilities for a global or national portfolio is complicated enough, not to mention the added challenge of wrangling cross-functional data from various departments in order to make informed decisions.

RefineRE can help Facilities Managers tackle some of their most pressing challenges:

- Lack of visibility into total cost of occupancy

- No clear understanding of how workspace is being used

- Increasing pressure to reduce operating and capital expenses

How RefineRE Helps Facilities Managers

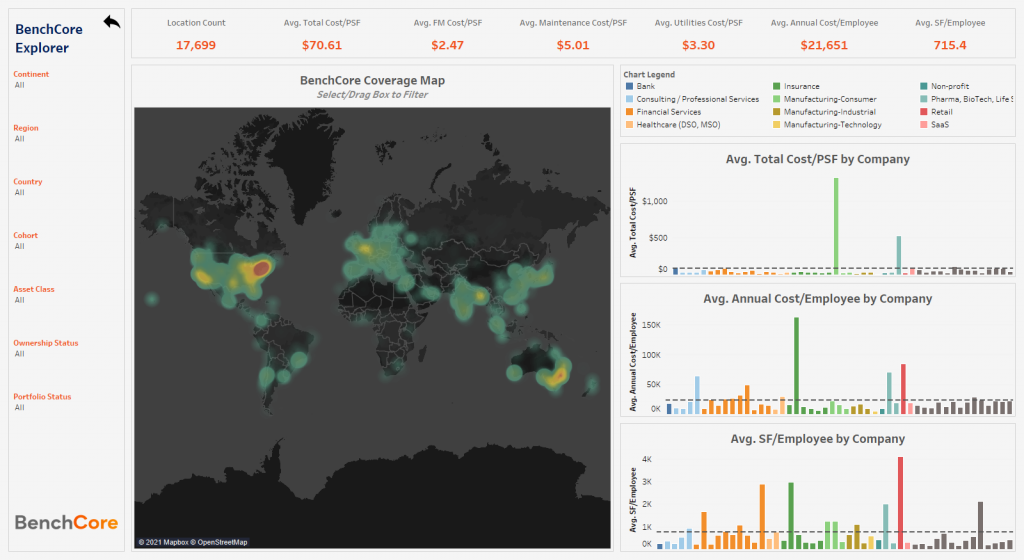

BenchCore Module

Give context to your real estate portfolio by comparing your organization to yourself and peers. With BenchCore, you’ll have access to benchmarking data on a global scale.

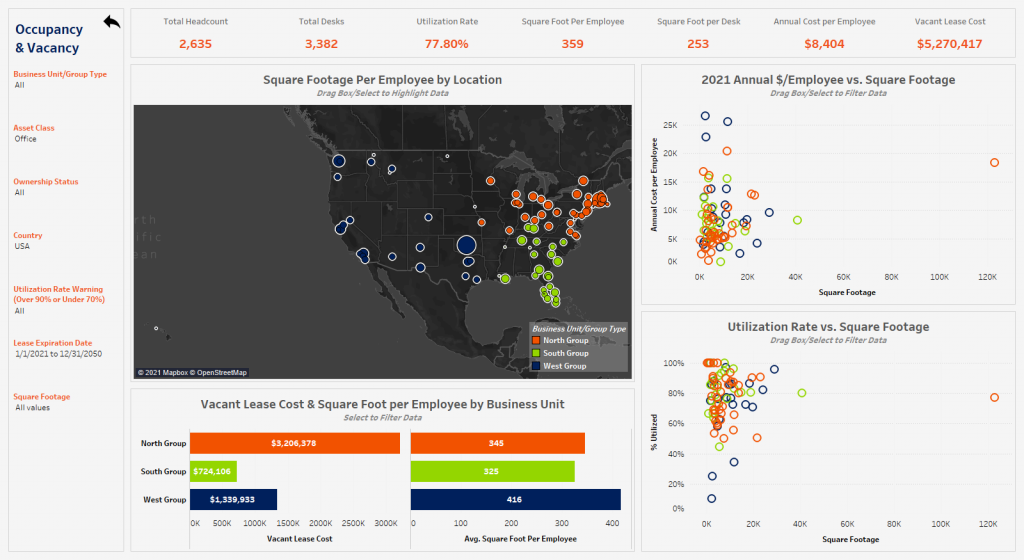

Workplace Module

Maximize and analyze space efficiency by aligning human capital and workplace strategies. RefineRE’s Workplace incorporates multiple data sources to inform your back-to-work strategy.

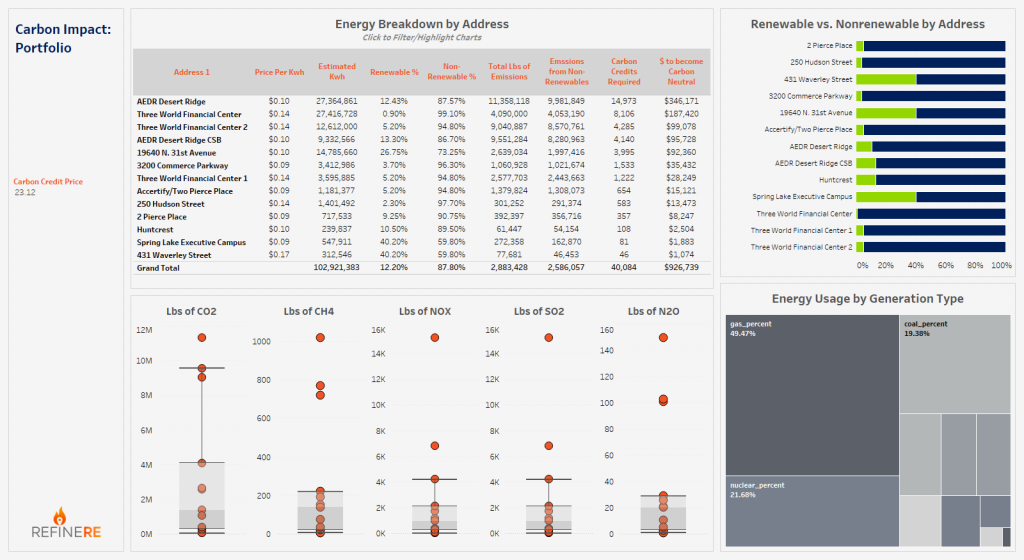

ESG Module

Measure, analyze and optimize your sustainability footprint to increase investor capital, meet ESG commitments, and increase brand value. Track trends and benchmark your water and energy spend to support sustainability strategy.

View Our Other Modules:

Make defendable short- and long-term decisions about your CRE portfolio. RefineRE’s easy-to-navigate dashboard provides corporate portfolio managers the ability to view and analyze key commercial real estate data metrics.

Get a single, supervisory view and wider context of your entire commercial real estate portfolio at your fingertips by consolidating and visualizing critical CRE data points from disparate business systems.

RefineRE Market Intelligence helps to identify commercial real estate leases that are priced either over or under market while calculating potential risk and cost savings. Gain visibility into detailed corporate lease comparisons and access general market data reporting tools to stay up to date on performance trends across your CRE portfolio.

Would your organization benefit from transitioning to a flex workspace? Find out with RefineRE FLEX. With FLEX, you’ll be able to identify which commercial leases could benefit most from transitioning to flex space and examine details of individual flex space options nearby.

Schedule a consultation with RefineRE

Here's what you can expect:

- ‣ A 15-minute call

- ‣ Identify your biggest challenges

- ‣ Explore automated solutions to optimize your strategy